Do you dream of letting go of your advisor who still lives in the fax age and never answers the phone when you have a question? Good news, because the neo-bank Revolut wanted to Uberize the payment card and is marketing free (and paid) accounts for all profiles – from the youngest to the most sophisticated. I tested its value proposition for you, and here is now my opinion on Revolut.

Among the pioneers of Fintech, I ask Revolut. Founded in 2014 in London, the company is no longer a startup since it has increased its fundraising - including the latest of 500 million dollars carried out last February - but has, as its name suggests, offered a real a burst of novelty in a sector still prey to the old principles of 2.0: banking.

Having been a user for over a year now, I have had the time to discover all the features of this application and to identify its strengths and weaknesses. The ideal opportunity to take stock of the possibilities offered by the neo-bank Revolut.

Revolut: understanding the neo-bank

Learn everything in five minutes about Revolut accounts. Below, I have prepared for you the main questions you may have when opening an account. Below, I will detail all the elements of the application and service, as well as my opinion and my opinion on Revolut.

Who can become a Revolut customer?

Unlike traditional banks which require you to go to a branch to sign a paper contract and photocopy documents that will end up forgotten, the neo-bank Revolut requires very little effort to become a member. The only two conditions to be eligible are to be of legal age and to own a smartphone, regardless of whether it is an Android or an iPhone.

Documents that take a long time to collect (such as tax returns or proof of address) are a thing of the past, and it only takes a few minutes to open an account on Revolut. It's super practical, the procedure is fluid and there is no chance of encountering any difficulty.

Open a Revolut account in 5 steps

But then, how do you go about creating your Revolut account and being able to start using your card? Here is the procedure to follow – which is obviously completely free:

- Visit the official Revolut website

- Enter your mobile phone number in the field provided for this purpose

- Click on the link received by SMS to download the Revolut app

- Take a photo of your ID card as requested by the app

- Finally, order your Revolut card, which will be delivered in less than a week

Is the customer service up to par?

According to verified reviews about Revolut published on Trustpilot, the firm receives 79% “excellent” ratings and 12% “good”. Our colleagues also have an excellent ratingfor Revolut overall, but alsofor the free account. The feedback is a little more mixed on Glassdoor, with 77% of employees approving the CEO, Nikolay Storonsky.

Finally, on the App Store, the application obtains an excellent overall rating of 4.9 stars out of 5, compared to 4.7 on the Google Play Store. This also includes a chat to interact with a bot in case of questions, the conversation can be redirected to a human if necessary. In short, nothing to say from this point of view in my opinion about Revolut.

© Revolut

Professionals are also entitled to their Revolut card

In addition to its accounts for individuals, the online bank Revolut has also set up packages for businesses. Here too, a free subscription provides access to basic services, but three paid offers are offered. Count between 25 and 100 euros (or more) per month with access to the API of its application to be able to integrate software or other applications.

Packagesdevelopment,growthetbig companyalso include benefits from many partners, including Google Ads or WeWork, as well as priority support which can be very useful in the event of a problem. Finally, in all subscriptions (including the free one), credit e-cards can be generated in order to share the account between the different members of a team.

Testing the Revolut app

Seduced by its positioning and ease of use, I registered with Revolut several months ago, and over time I was able to try all the features of its application on my iPhone. Most options are also available on the Android version of the mobile application.

Design & UX

The Revolut application benefits from minimalist and refined ergonomics in keeping with the times. Unfortunately, no dark mode in the program as we know users are crazy about lately, but a white interface with colored pictograms which very well describe the different tools available. By testing the Revolut mobile bank, I really quickly formed an opinion on its UI: it is intuitive, without frills, and it is very easy to navigate between the different bank accounts.

© iPhon.fr

We feel that the developers have thought about designing a secure and fluid service: no slowdown is to be reported, whether on iOS or elsewhere. The only downside: there is no version on Mac, and there is no desktop version either. You will therefore have to be content with the Revolut mobile app on iPhone or Android only. Which can be disabling for certain professional profiles such as traders, especially when we know that the online bank N26 has thought about this alternative, but we will come back to that a little later.

Features available on Revolut

Let’s get down to business in this Revolut review. What can you do with the neobank from its mobile application? Actually, a lot of things. The possibilities are numerous, but if we had to choose only twenty here are the ones that I would rank among the best:

- alerts to monitor the values of certain prices (euro, dollar, etc.)

- summary of daily transactions and operations

- bank transfer <48 hours (faster than a traditional bank!)

- Instant sends and money requests to contacts who are also at Revolut

- budgeting, to manage your accounts by category (food, leisure, subscriptions, etc.)

- comprehensive statistics in the form of personalized and colored graphs depending on the time frame

- bill sharing: practical for Netflix or evenings at the restaurant

- recurring direct debits

- payment links, to receive money by sharing a simple URL

- detection of Revolut users around you, like AirDrop

- sponsorship: you can earn €22 when a friend creates an account on Revolut

- unlocking the PIN code of the credit card

- immediate card blocking: no more waiting on the phone

- currency exchanges with live exchange rates

- “chests” are virtual sub-accounts to put aside

I will come back in detail in the next points on the functionalities of the Revolut app.

© Revolut

Revolut compatibility with iOS

The Revolut application is particularly well integrated on iPhones. The software still weighs more than 300 MB, but it is compatible with more than 25 languages ranging from French to English, Spanish and also German.

iPads, Apple Watches and iPod Touches can also download the Revolut online banking application, and this can be unlocked using Face ID (TrueDepth) biometric sensors on the iPad Proor Touch ID on iPhone SE. In addition, the neobank's cards can be scanned into Wallet, to be able to pay for purchases with Apple Pay technology.

In addition, there is also an appRevolut Juniorwhich allows you to manage accounts for children. Finally, family sharing offers the possibility for an entire family to use the application together using up to 6 different devices. Also practical for roommates who share the meal budget.

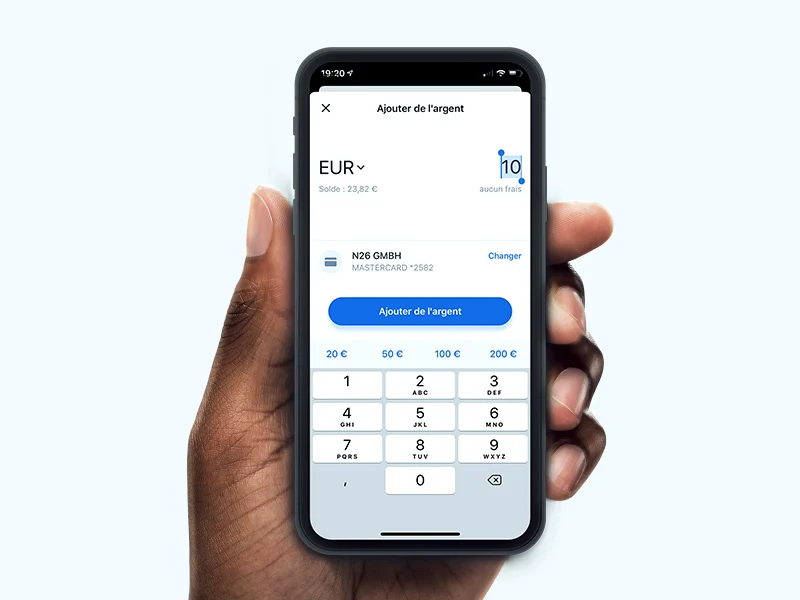

Connected payment

Like all online banks, Revolut allows you to pay on the Internet and provides 3D-Secure two-factor authentication on all its cards, whetherMasterCard SecureCodeor fromVerified by Visa. Revolut cards also include an NFC chip, for contactless payment in stores, and also synchronize without problem with the Google Pay wallet.

© Revolut

Invest with the Revolut app

The Revolut app certainly does not offer any profit-sharing on your accounts, but does allow you to invest in several values, including crypto-currencies, shares of certain companies or even raw materials. But not all of these theses are as advantageous as each other with this intermediary. This is a positive point in my Revolut review. Here are all the details below.

Buy Bitcoin

The online bank Revolut has a key advantage over traditional banks: it allows you to invest in cryptocurrencies. Customers can thus select Litecoin (LTC), Bitcoin Cash (BCH), Ripple (XRP) or even Ether (ETH). Obviously, the global success of Bitcoin (BTC) is also just a click away.

But there too, there is a catch: Revolut does not offer a real virtual wallet as is the case with the Binance, Coinbase, Wirex or CoinFalcon apps. Understand that you will not be able to send or receive cryptocurrencies to anyone, or even benefit from a BTC address. You can only bet on the growth of certain virtual currencies, and then make a profit by transforming your stake back into classic currency.

© Revolut

Investing in the stock market

In a similar way, the Revolut app allows you to invest in the stock market without experience, which is not possible with traditional banks. It is the trading part of the app that allows you to engage in these operations which, we cannot stress enough, are also risky. Here are some securities in which it is possible to invest:

- les studios Fox, Viacom et Disney

- publishers Adobe, Autodesk and Oracle

- the banking sector, with American Express, Axa, Santander, Bank of America, Goldman Sachs, Mastercard, Morgan Stanley, Visa, Wells Fargo and Western Union and the FinTechs PayPal and MoneyGram

- les fonds Berkshire Hathaway, BlackRock et JPMorgan

- les fabricants AMD, Broadcom, Canon, Xerox, Cisco, IBM, Intel, Nvidia, Qualcomm, Roku, Seagate, Texas Instruments, Western Digital, Blackberry, Caterpillar, Corning, LG, Motorola, Dell, HP et Sony

- GAFAM Alphabet, Amazon, Apple, Facebook and Microsoft

- e-commerce with Best Buy, eBay, Etsy, Home Depot, Macy's, Target and Walmart

- the future of food with Beyond Meat

- connected objects from Fitbit, Honeywell and GoPro

- the BATX Baidu and Alibaba

- operators Altice, AT&T, China Mobile, T-Mobile, Verizon

- the airlines American Airlines, China Southern Airlines, Delta Air Lines, JetBlue Airways and Southwest Airlines (and the manufacturers Lockheed Martin and Boeing)

- Lyft an Uber

- le streaming : Netflix et Spotify

- le New York Times

- travel with Booking, Expedia, Hilton, Hyatt, Marriott, TripAdvisor and cruises from Royal Caribbean Cruises and Norwegian Cruise Lines

- hosting from Box, Cloudflare, Dropbox and GoDaddy

- les SAAS DocuSign, Eventbrite, Fiverr, HubSpot, Salesforce, Shopify, Slack, Twilio, Zendesk et Zoom

- social networks Pinterest, Snap, Twitter and Weibo

- Clear Channel

- Virgin Galactic

© iPhon.fr

Commodity trading

On the other hand, the Revolut application also allows you to invest in certain raw materials. For now, only gold is eligible, but other metals are expected to arrive in the near future. This new feature was added at the beginning of 2020. To be able to participate, however, you must have a Premium or Metal account, which means that free users cannot trade with this tool.

Additional services

In addition to trading, Revolut offers some very practical advantages, especially for those who are more nomadic. They are generally included in the different packages offered by the neo-bank. Below in my review of Revolut, the additional elements.

Revolut insurance and guarantees

Revolut helps protect your mobile device worldwide, including covering it against screen breakage and liquid damage. Knowing that one in four people damage their phone each year, this is security in addition to the warranty provided by the manufacturer which is welcome, especially if you do not use a case.

In terms of cost, Revolut insurance would be 65% cheaper than having your iPhone repaired in an Apple Store: in fact, you normally need to spend at least a hundred euros for this type of financial transaction. The costs of this service are calculated based on your equipment. For a 256 GB iPhone

© Revolut

With this, Revolut also allows you to obtain medical insurance abroad. A winter sports option is also available, and the regions covered are very large since in addition to Europe, North America and most other countries recognized by the UN are concerned. Eligible treatments include emergency dental treatment and rapid reimbursement of commissions directly to the user's Revolut account.

Revolut allows you to make donations

Like Lydia, the Revolut application allows you to make donations to charities. Eligible organizations include Médecins Sans Frontières, Save the Children, Rainforest Alliance, Movember, WWF and ILGA-Europe, which defends LGBTQI+ rights. Revolut specifies that it does not apply any fees and does not take any commission, all donations being sent directly to NGOs.

Save time with the concierge service

The Revolut Metal package provides access to a concierge service to carry out everyday operations for you such as booking hotels, restaurants and flights or organizing events. Request submissions are made directly from the mobile application, while requested actions are confirmed by return email.

Obviously, the final amount payable by you will not be debited from your Revolut account until you have validated it yourself. The concierge service is open constantly, at any time of the day or night and every day of the week. This is an argument that weighs positively in my Revolut review, but that's not why I asked for it.

© iPhon.fr

The bonus for travelers

If you're used to traveling, whether for business or leisure, Revolut can also give you access to over 1,000 private airport lounges at a great price. Additionally, the functionalitySmartDelayoffers this access for free if your flight is delayed by more than an hour, an option again only available with a paid Revolut plan.

Note that with a Revolut Metal subscription, the first lounge access is free.

Comparison of Revolut plans

Revolut currently offers 3 packages to its subscribers, and I will quickly detail them for you in my Revolut review below.

The first subscription, the Standard plan, is generally free. However, there are some hidden fees, such as a 2% commission on withdrawals above 200 euros per rolling month. Currency exchanges are also free of charge, up to 6,000 euros per month, but you will then have to pay 0.5% for each transaction. Finally, all card transactions and transfers are free.

© iPhon.fr

With a Premium package, you benefit from the same advantages with the addition of eight stock market transactions each month. This subscription also unlocks commodity trading and Smart Delay, while customer service is advertised as more responsive. This package also allows you to have access to medical insurance for €0 more, covers luggage delayed at the airport and offers a 20% discount on your smartphone insurance. Withdrawals from ATMs are free, this time up to 400 euros per month, and foreign exchange transactions without any limit. Count on 7.99 euros per month for Revolut Premium.

Finally, by paying 13.99 euros per month with Revolut Metal, you will have access to the best online banking offer. This allows you to earn 1% cashback on all card payments, and unlocks the concierge service. All the benefits of Revolut Premium are also included, while ATM withdrawals are offered up to 600 euros per month. Now it's time to give you my opinion on Revolut.

French IBANs in 2022

Since the creation of Revolut, all French customers have had a Lithuanian IBAN for their account. Even if few people use it, each user has a bank account with an IBAN. This allows, for example, to fund your account by bank transfer, or send funds to a traditional bank. Since Revolut was registered in Lithuania, the accounts had a Lithuanian IBAN.

And this sometimes poses a problem in Europe, where there is still real discrimination in the IBAN (which is an illegal practice). For example, an employer could refuse to pay you your salary on an IBAN that was not French. Likewise, an energy supplier or a telecom operator could refuse (illegally) to make withdrawals from non-French accounts.

Since mid-2022, Revolut has evolved: French customers now have the right to a French IBAN. It is one of the rare neo-banks to offer such a service – which is not the case with N26 for example (which has a German IBAN). This allows you to make Revolut your primary bank account, with no limits.

Conclusion: make your life easier with thisbanque application

In my opinion, Revolut is an ideal application for all smartphone users of the 3.0 era who like speed, fluidity and efficiency. Its few flaws are quickly overshadowed by an experience without the slightest reproach, regularly updated functionalities and a contemporary positioning which clearly contrasts with the traditional “bank”.

Finally, everyone can use Revolut, from students on a tight budget to the most demanding executives. The free offer allows you to try the product – and you will very quickly be convinced to migrate to the paid offers. That said, by default, the free offer alone is already sufficient if you use it mainly in France.

Share your opinion on Revolut with us in the comments.